Belgium Fiscalization

Setup

Belgium fiscalization setup consists of several components: Fiscal data module, FDM server, FDM client SDK and POS4 Belgium fiscalization plugin.

Fiscal data module is the fiscalization black box. It is possible to use one black box for multiple tills as long as they are connected via network.

FDM server is a service that needs to be installed on the machine where the fiscal data module is connected.

FDM client SDK should be installed on each till where Belgium fiscalization should be used.

Belgium fiscalization plugin is a POS4 plugin that provides the fiscalization functionality in POS4.

Configuration

Fiscalization setup can be configured following the steps below. Documents referred to in this section can be found in sharepoint under:

Data\Customers\Documents\Lagardère Travel Retail BE\Projecten\2023 - BE Black Box\BoxAPos.

Server-side configuration

Here, the server-side represents a machine where the fiscal data module is connected. It can be a standalone server, or it could be a POS machine as well if a standalone one is not available.

- Install the fiscal data module following document \User manuals\user manual.pdf.

- Install FDM server following document Part 1 - Installation Guide.pdf. The installation file is in \Microsoft Windows\FDM.Server.win.x86.x64_3_5_14[IncludesPatchForRounding].msi.

- Configure FDM server following document Part 2 - Configuration Manual.pdf. If fiscal data module will be shared and POS4 applications will run also on different machines than where the FDM server is installed, it will be necessary to configure the Network interface using the IP address of the FDM server machine (chapter 6.6.2 in mentioned document).

- Download the key file from FDM server portal manually (chapter 6.7 in the same document). Key file option is accessible from the Configuration option from the Main menu. Keep the chosen passphrase, it will be necessary to configure it on POS.

POS configuration

The following steps should be performed on each POS where transactions should be fiscalized.

- Install the FDM client SDK. The installation file is in \Microsoft Windows\FDM.ClientSDK.win.x86.x64_3_3_11.msi

- Copy the key file from the portal into C:\POS\Data\fdm.key.

- Configure and activate the fiscalization plugin BelgiumFiscalPlugin.dll in the POS database. Plugin dlls (BelgiumFiscalPlugin.dll and FDM.Client.dll) will be downloaded on POS startup.

- Configure the following parameters in the POS database.

| Parameter name | Value | Description |

|---|---|---|

| Belgium.PosSerialNumber | 14-character string | Value needs to be in format AXXX (or BXXX) CCCPPPPPPP as described in document \Circulaire ET124747\EN\ CIRCULAR.rtf in chapter 3.2 point 23. |

| Belgium.TerminalId | string | Unique ID of the POS |

| Belgium.TerminalDescription | string | Description of the POS (optional) |

| Belgium.Passphrase | string | Passphrase used to generate the key file in point 4 of the server-side configuration |

Other requirements

Every POS user should have their social security number (INSZ or BIS) set in the system. This value can be entered in the Security field in the Resolut online portal.

VAT rates should be configured as in the table below.

| VAT description | VAT rate |

|---|---|

| A | 21% |

| B | 12% |

| C | 6% |

| D | 0% |

The following parameters should be configured on POS to block the prohibited functionality.

| Parameter name | Parameter value |

|---|---|

| AllowMixedSaleRefund | 0 |

| BlockConfigurationChanges | 1 |

| BlockReprintTicket | 1 |

| PrintVatNameOnTicket | 1 |

Fiscalizing transactions

The Following POS4 transactions are automatically fiscalized before transaction ticket is stored into database:

- Sign on

- Sign off

- Sale

- Employee sale

- Refund

- Transaction on hold

- Open drawer (as a standalone action, not as a part of finishing sale)

When fiscalization is successful, fiscalization information is added to the end of the transaction receipt (with exception of open drawer transaction where no extra info is added).

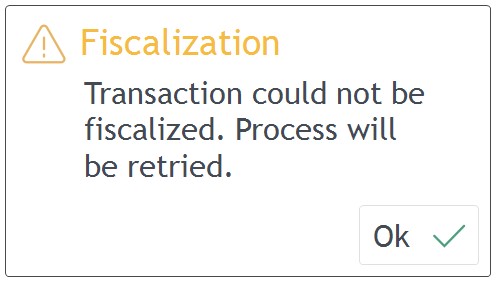

If fiscalization is not successful, the cashier is notified and fiscalization must be retried.